Mortgage Broker Glendale CA: Aiding You Navigate the Home Mortgage Process

Mortgage Broker Glendale CA: Aiding You Navigate the Home Mortgage Process

Blog Article

The Thorough Function of a Home Loan Broker in Securing the very best Finance Alternatives and Rates for Your Home Purchase

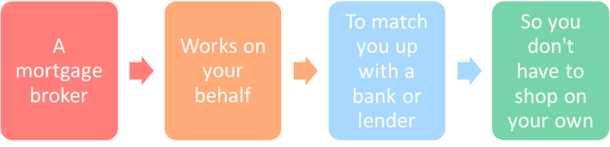

A home mortgage broker offers as a crucial intermediary in the home purchasing process, linking customers with an array of lending institutions to secure optimal financing choices and prices. By examining private economic situations and leveraging market insights, brokers are well-positioned to bargain favorable terms and improve the often complicated funding application procedure.

Recognizing the Mortgage Broker's Function

Home loan brokers regularly work as intermediaries in between debtors and lending institutions, facilitating the car loan acquisition process. Their key obligation is to assess the economic demands of customers and match them with ideal mortgage items from a series of loan provider. Mortgage Broker Glendale CA. This requires a comprehensive understanding of the home loan landscape, including different loan kinds, rate of interest, and lending institution needs

Brokers begin by gathering crucial monetary info from clients, such as income, credit rating background, and existing financial debts. This information is vital for identifying the most ideal loan alternatives offered. As soon as the necessary details is collected, brokers conduct complete marketing research to identify loan providers that straighten with the customer's needs, usually leveraging established connections with several banks to secure competitive terms.

In addition, home mortgage brokers provide assistance throughout the entire funding application procedure. They help customers in completing paperwork, making certain conformity with lending institution needs, and offering advice on enhancing credit reliability if required. By working as a bridge in between debtors and loan providers, home loan brokers streamline the often-complex process of securing a mortgage, inevitably conserving clients effort and time while increasing the possibility of safeguarding beneficial car loan terms.

Advantages of Making Use Of a Home Mortgage Broker

Furthermore, home mortgage brokers have accessibility to a wide range of borrowing institutions, which allows them to present debtors with a plethora of choices that they might not locate individually. This access can result in much more competitive prices and terms, eventually conserving consumers cash over the life of the lending.

One more advantage is the time-saving element of collaborating with a broker. They manage the facility documentation and arrangements, streamlining the application process and reducing the burden on customers. Additionally, brokers can provide customized support and guidance throughout the financing journey, fostering a feeling of self-confidence and quality.

Exactly How Home Loan Brokers Contrast Lenders

Brokers play an essential role in contrasting lenders to recognize the most suitable alternatives for their clients. They have extensive expertise of the mortgage market, consisting of various loan providers' terms, items, and rates - Mortgage Broker Glendale CA. This competence enables them to carry out thorough evaluations of the readily available car loan alternatives based on the special economic situations and choices of their customers

Mortgage brokers use specialized devices and data sources to collect up-to-date information on several lending institutions efficiently. They evaluate crucial variables such as rate of interest, finance try this fees, repayment terms, and eligibility demands. By contrasting these components, brokers can highlight the pros and cons of each option, ensuring their clients make notified choices.

In addition, brokers keep relationships with a diverse variety of lenders, including conventional banks, lending institution, and alternative financing resources. This network permits them accessibility to unique bargains and possibly far better terms that might not be available directly to consumers.

Eventually, a mortgage broker's ability to compare lending institutions encourages customers to protect competitive rates and favorable car loan conditions, enhancing the procedure of discovering the best mortgage solution customized to their private requirements.

The Funding Application Process

Navigating the loan application procedure is an essential action for clients seeking to safeguard financing for their homes. This process typically begins with the collection of needed documentation, including revenue verification, credit report reports, and asset declarations. A home loan broker plays an essential role below, assisting clients with the documentation and making certain all details is precise and complete.

When the paperwork is collected, the broker sends the finance application to several lenders, promoting a competitive setting that can cause better terms and prices. They likewise help customers understand different lending alternatives, such as fixed-rate, adjustable-rate, or government-backed fundings, ensuring the selected item aligns with their monetary situation.

Throughout the underwriting procedure, which involves loan providers reviewing the customer's credit reliability and the home's worth, the broker acts as an intermediary. They interact updates and resolve any extra demands from the lender, enhancing the procedure for customers. This support is important in reducing stress and anxiety and confusion, ultimately accelerating the authorization timeline. By leveraging their proficiency and market connections, home mortgage brokers boost the possibility of a successful finance application, making it possible for customers to relocate more detailed to homeownership with confidence.

Tips for Picking the Right Broker

Choosing the best home loan broker can dramatically influence the overall lending experience and outcome for clients. To ensure a successful collaboration, consider the complying with tips when selecting a broker.

First, examine their experience and reputation within the market. Try to find brokers with a tried and tested performance history in protecting positive loan terms for clients with varying monetary accounts. Mortgage Broker Glendale check this CA. Reading reviews and seeking recommendations from trusted sources can supply beneficial understandings

2nd, examine their series of lender connections. A broker with access to multiple lenders will be better positioned to provide diverse funding choices and affordable prices, ensuring you discover the most effective fit for your requirements.

Third, ask about their communication style and availability. A responsive broker who focuses on customer interaction can assist ease anxiety throughout the finance process.

Lastly, ensure they are clear regarding their charges and payment structure. A trustworthy broker will certainly supply a clear malfunction of expenses in advance, helping you avoid unanticipated costs later.

Conclusion

By leveraging market knowledge and negotiating beneficial terms, brokers improve the probability of safeguarding optimum lending choices and prices. Picking the appropriate home mortgage broker can lead to an extra effective and reliable home acquiring experience, inevitably adding to informed economic decision-making.

A home mortgage broker offers as a crucial intermediary in the home purchasing procedure, attaching purchasers with a variety of loan providers to protect ideal funding choices and rates.Mortgage brokers frequently act as middlemans in between lending institutions and debtors, assisting in the finance purchase procedure.Furthermore, mortgage brokers provide support throughout the whole finance application process. By offering as a bridge in between additional reading lending institutions and debtors, mortgage brokers streamline the often-complex procedure of securing a mortgage, inevitably conserving clients time and initiative while enhancing the likelihood of safeguarding beneficial lending terms.

By leveraging their proficiency and sector connections, mortgage brokers boost the possibility of an effective finance application, enabling customers to move more detailed to homeownership with confidence.

Report this page